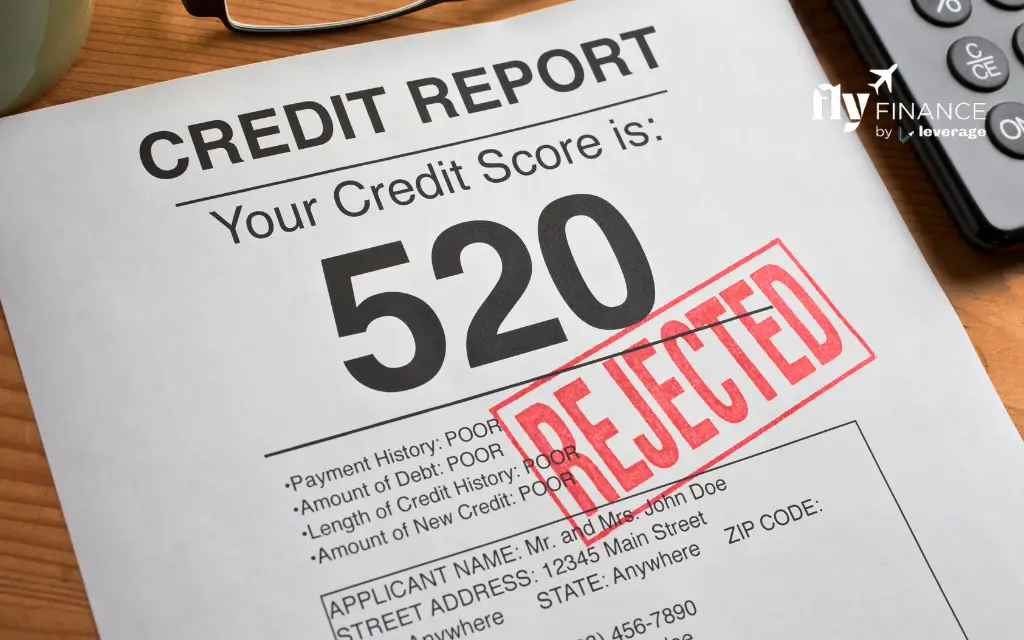

Maintaining a good credit score is a challenging task as one small mistake can have a major impact on it. Even if you delay any EMI or credit card bill payment by one day, it will reflect on your credit report. Any payment that is overdue by 30 days or more is considered delinquent and ultimately reduces your credit score. Hence, it is very important to understand the preventive measures and strategies to fix delinquencies in credit reports. Read on to learn more about how to fix delinquency on credit reports.

Table of contents

Understanding Credit Delinquency

Credit delinquency occurs when you fail to make payments on your credit accounts by the due date. Delinquencies are categorised based on the duration of missed payments, such as 30, 60, 90, and 120+ days late. The longer the delinquency in credit report, the more damaging it is to your credit score. Once damaged, it takes a very long time for the credit score to recover. However, it’s not necessary that due to one category of repayment, the other category will also be affected.

For example, if your credit card bill payment is delayed and is considered delinquent, then your credit score in the credit card category will reduce while the loan category may remain constant. This may also vary depending on the lender i.e. if it’s a bank, NBFC or any other financial institution.

Also Read: Most of the banks provide a grace period or moratorium on education loans. Check here all about purpose of grace period of student loan

Step-by-Step Guide to Fixing Delinquency

There are certain steps which can help you in getting your delinquency fixed or removed from your credit report. However, none of these measures are guaranteed and shall be considered just an attempt to fix delinquency on credit reports. Check all the steps in detail below:

Download Credit Report

Request a copy of your credit report from the three major credit bureaus: Equifax, Experian, and TransUnion. There are multiple apps also which can provide you with the window to download credit reports for free such as Paytm, PhonePe, BankBazaar.com etc. Download through these portals and review your reports carefully to identify any delinquencies and verify their accuracy.

Verify Accuracy

Check for errors in the delinquency entries, such as incorrect dates, amounts, or account numbers. Look for any fraudulent accounts or unauthorised transactions that might have contributed to the delinquency. There are sometimes wrong entries that affect your credit score even if it’s not your fault.

Also Read: Check here what is a moratorium period and how it works

Dispute Errors

If you find inaccuracies, dispute them with the credit bureau reporting the error. You can file disputes online, by phone, or by mail. You also need to provide relevant documents to support your claim, such as payment records or correspondence with creditors. The credit bureau is required to investigate and respond to your dispute, usually within 30 days. You should also note that in case you have made the repayment recently, then it will take some time for the CIC to update your record. Usually, it takes 10-12 days for a payment to be updated in the record.

Negotiate with Creditors

Contact your creditors directly to discuss your delinquency. Explain your situation and ask if they can remove the delinquency from your report. You can also request a “goodwill adjustment” if you have a history of timely payments and the delinquency was a one-time incident. Consider negotiating a “pay for delete” agreement, where you agree to pay off the debt in exchange for the creditor removing the delinquency from your report.

Also Read: Wondering what is past due reflected in a credit report? Check this blog and know what is Days Past Due in CIBIL Report

Settle Outstanding Debts

If there are any kind of outstanding dues then pay them immediately as they must be causing the delinquency. Prioritise accounts that are severely past due. Also, set up a payment plan if you cannot pay the full amount immediately. You get to apply for a loan restructure which will help you to reduce your monthly payments and adjust it as per your convenience.

Tips for Preventing Future Delinquencies

Instead of looking for how to fix delinquency on a credit report, you must try not to delay any payment in the first place. However, sometimes there might be certain conditions which will become a hindrance in paying off debt timely. In order to avoid such conditions and prevent future delinquencies, try implementing the tips given below:

- Develop a budget to manage your expenses and ensure you have enough funds to cover your bills each month. Keep aside the amount required to pay for EMI and credit card bills

- Use calendar alerts or financial apps to remind you of upcoming payment due dates. Keep the account funded at least 3-4 days prior to the date of EMI

- Always set up automatic payments i.e. NACH or ACH for your bills to avoid missing due dates.

- Build an emergency fund to cover unexpected expenses, reducing the risk of missing payments during financial hardships.

This was some of the strategies and tips on how to fix delinquency on credit report. Always try to pay off your EMIs and bills on time to maintain a high credit score and good financial health. Check some common FAQs on how to fix delinquency on credit report.

FAQs on How to Fix Delinquency on Credit Reports

Credit delinquency occurs when you fail to make payments on your credit accounts by the due date. Delinquencies are categorised by the duration of missed payments (e.g., 30, 60, 90, and 120+ days late). The longer the delinquency, the more it negatively impacts your credit score.

You can request a copy of your credit report from the three major credit bureaus: Equifax, Experian, and TransUnion. Alternatively, you can use financial apps such as Paytm, PhonePe, or BankBazaar.com to download your credit report for free.

If you find inaccuracies in the delinquency entries, such as incorrect dates or amounts, you should dispute them with the credit bureau that reported the error.

Yes, you can contact your creditors directly to discuss your delinquency. Explain your situation and request a “goodwill adjustment” if you have a history of timely payments and the delinquency was a one-time incident. You can also negotiate a “pay for delete” agreement, where you agree to pay off the debt in exchange for the creditor removing the delinquency from your report.

To avoid future delinquencies, develop a budget to manage your expenses and ensure you have enough funds to cover your bills each month. Use calendar alerts or financial apps to remind you of upcoming due dates and set up automatic payments for your bills.

To know more about education loans, the best bank accounts for students, forex and banking experience for global students or international money transfers, reach out to our experts at 1800572126 to help ease your study abroad experience.

Follow Us on Social Media