EMI options your wallet prefer

Travel ? Treat yourself with a vacation. Want to go full-time

with your hobby ? Explore our light EMI options.

Travel ? Treat yourself with a vacation. Want to go full-time with your hobby ? Explore our light EMI options.

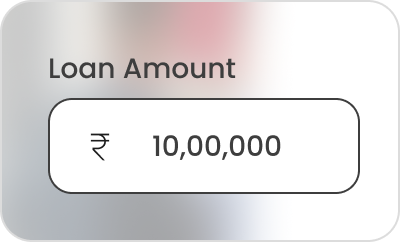

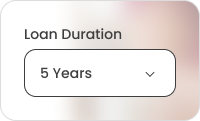

You're in control

Borrowing made easy - select your desired amount and duration, keep track of your payments, outstanding balance and associated costs effortlessly.Pick a repayment date that fits your schedule and modify it anytime at no extra charge. Need to make multiple changes? No worries, just reach out to us.

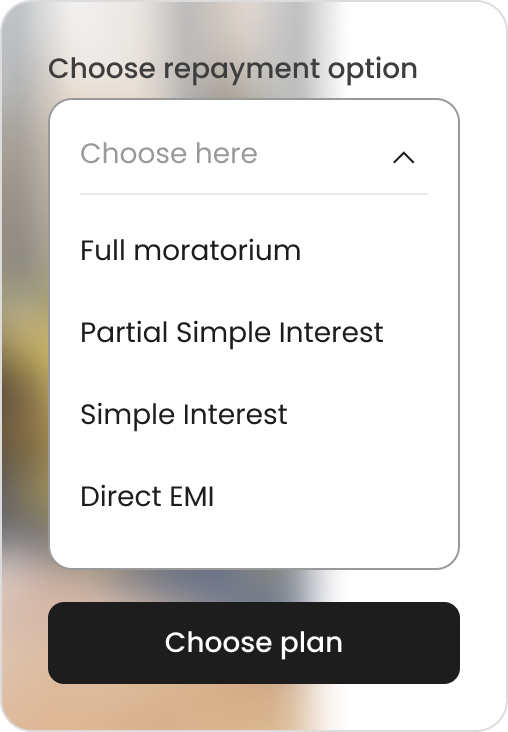

Pay your loan,

the way you want it

It's your loan so you shouldn’t have to jump through hoops to use it. Want to make your monthly repayment early or pay off a little extra? No problem. You can do it straight from the app with no fee.We make sure the loan repayment option is as student friendly as the loan processing.

Securing a personal loan

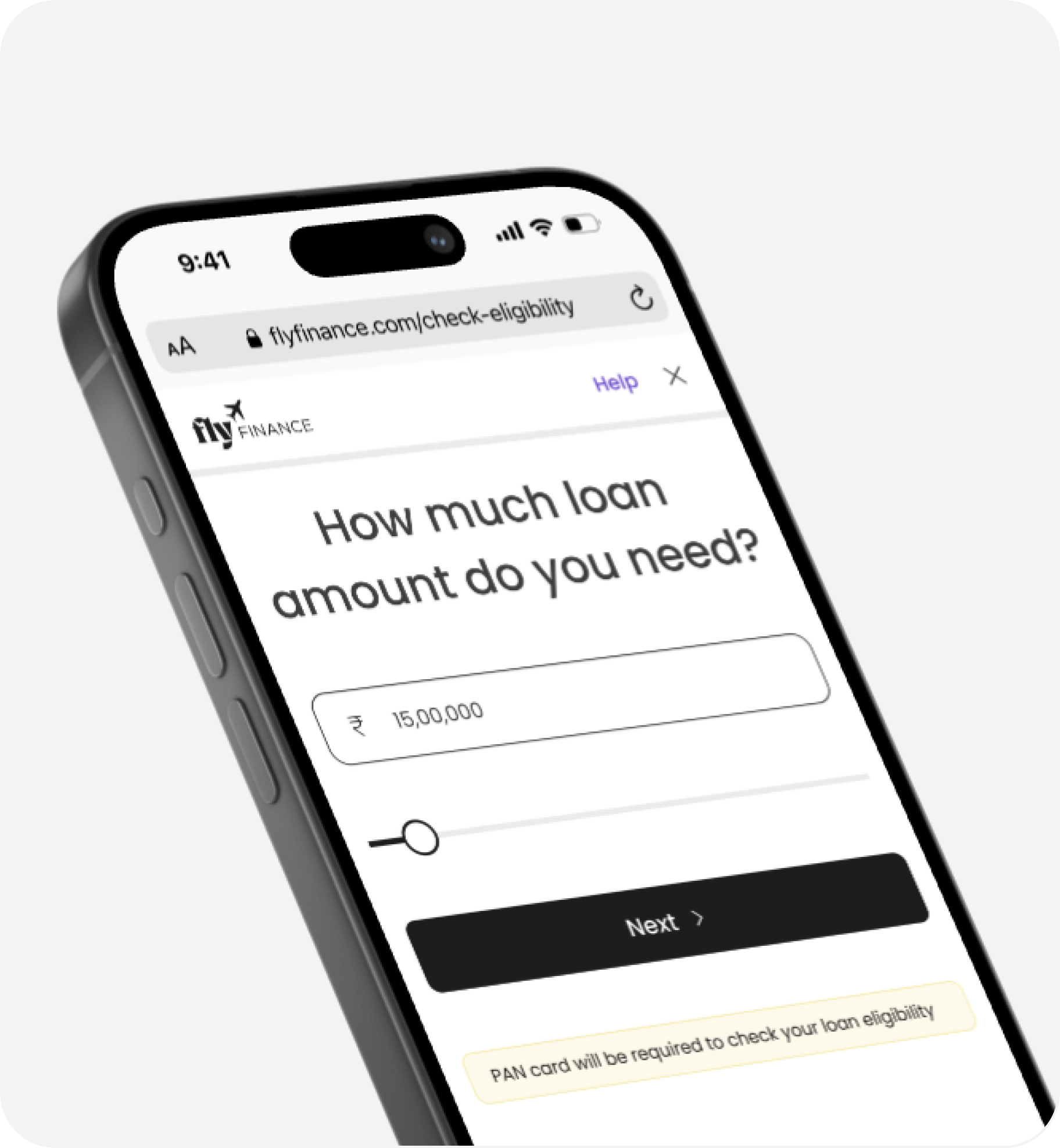

Check how much you want to borrow

Select the loan amount that suits your needs. Whether it's a small boost or a larger sum, choose the amount that aligns with your financial goals.

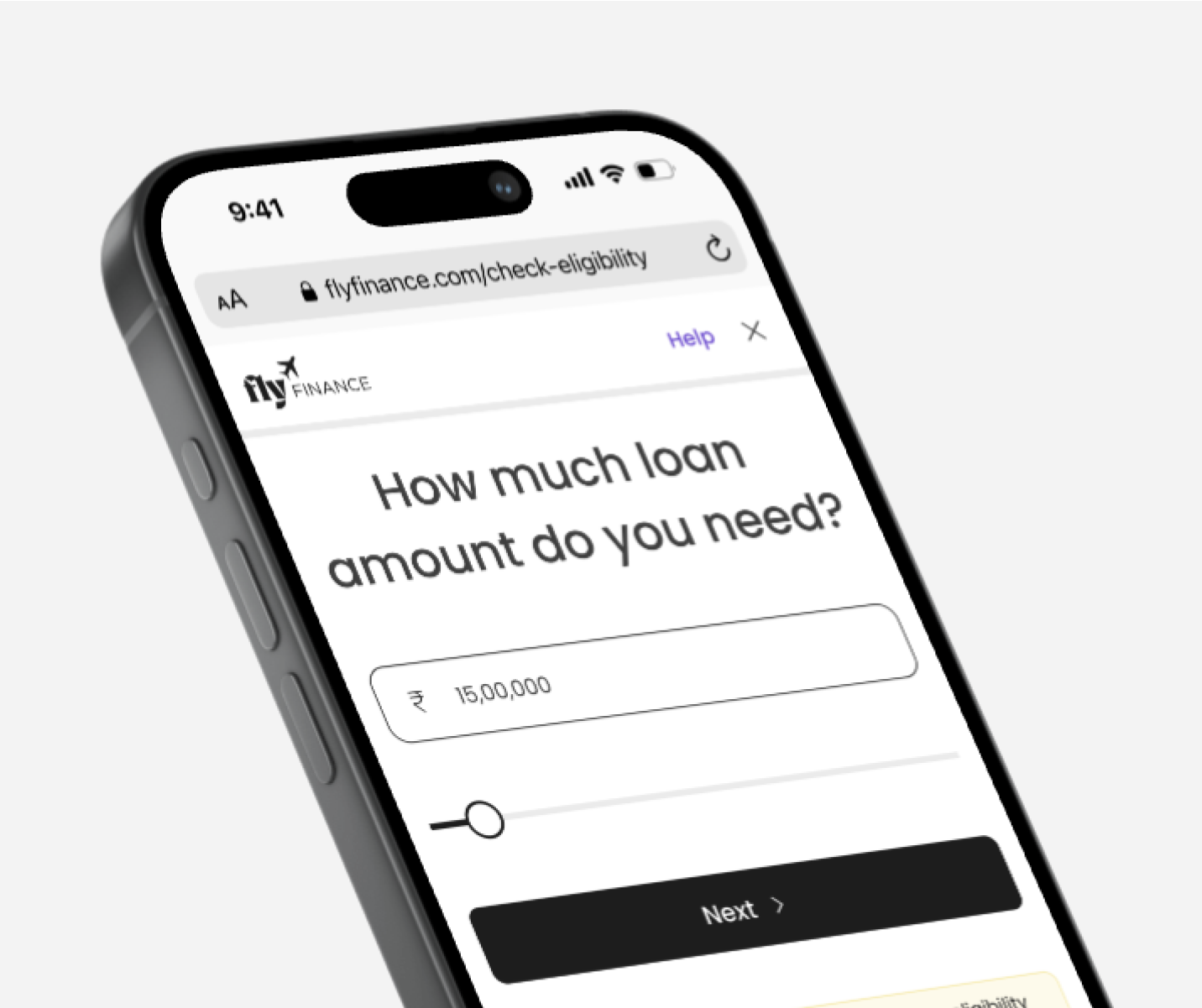

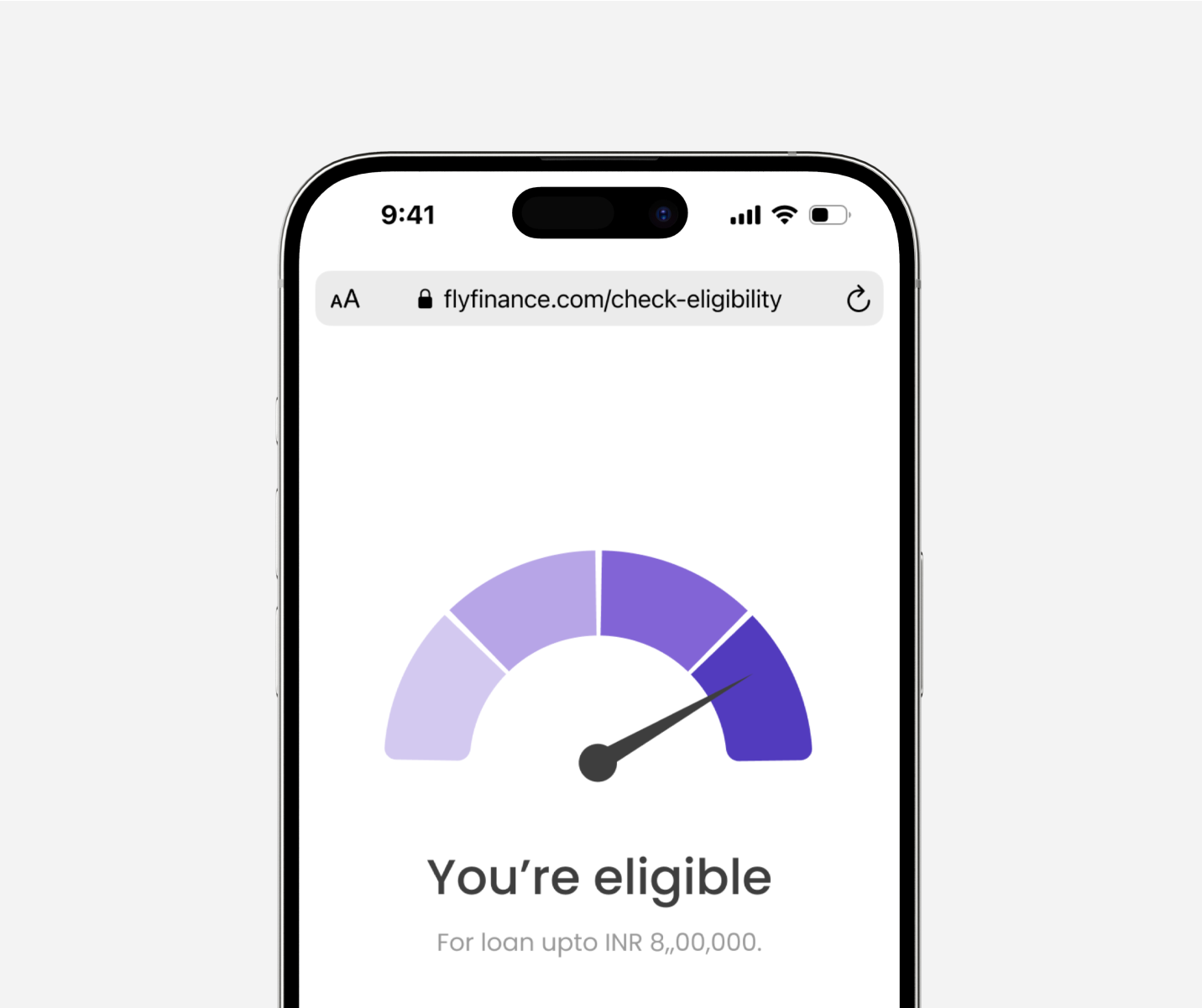

Check eligibility

Whether you're planning a vacation, purchasing a vehicle, or embarking on a shopping spree, we've got you covered. Simply check your eligibility, and get started today!

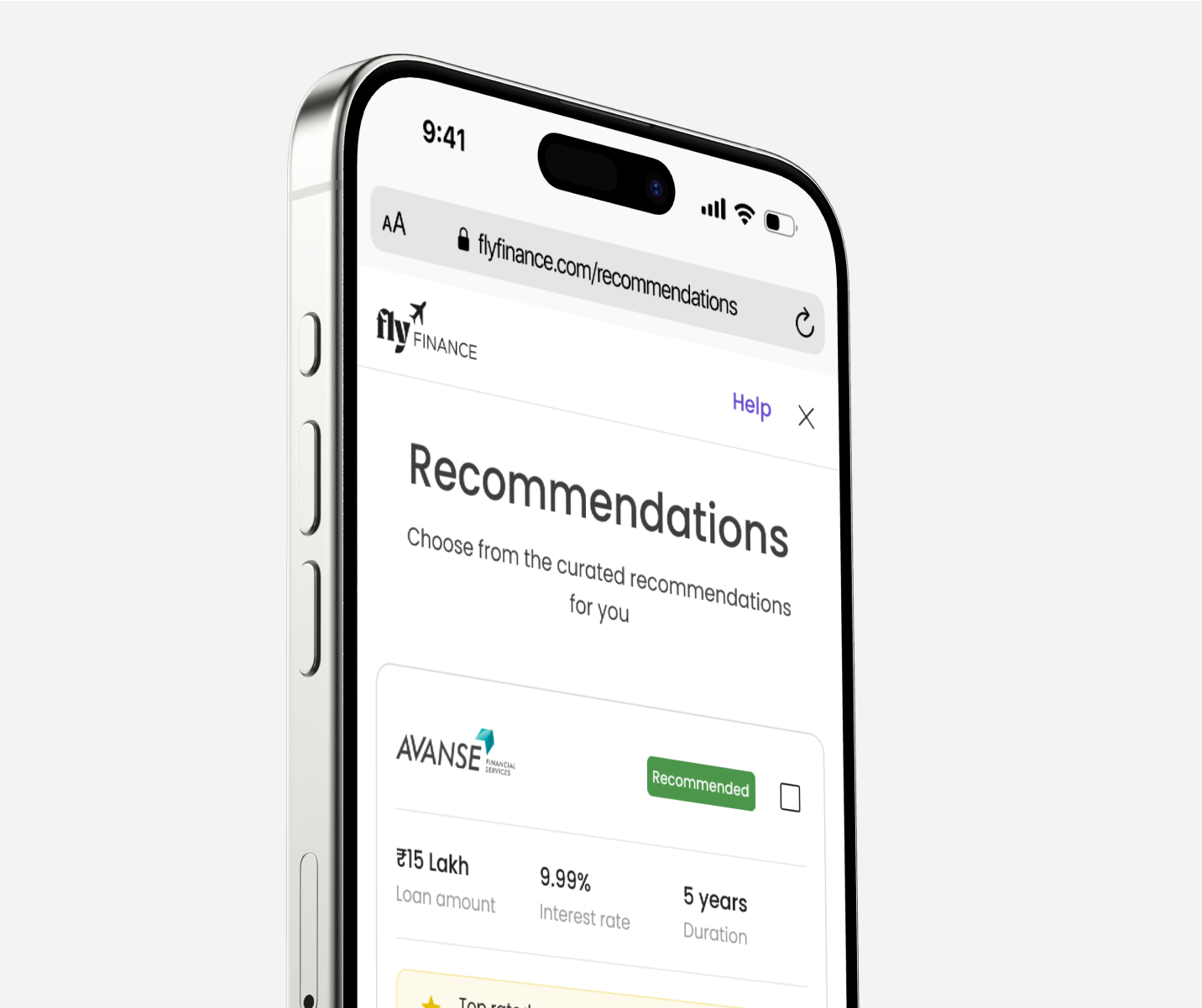

Choose a lender

Find the perfect match for your needs. Explore a range of trusted lenders, compare their offers, and select the one that suits you best. With competitive rates and flexible terms, you’re just a step away from securing the ideal loan for your goals.

Check how much you want to borrow

Select the loan amount that suits your needs. Whether it's a small boost or a larger sum, choose the amount that aligns with your financial goals.

Check eligibility

Whether you're planning a vacation, purchasing a vehicle, or embarking on a shopping spree, we've got you covered. Simply check your eligibility, and get started today!

Choose a lender

Find the perfect match for your needs. Explore a range of trusted lenders, compare their offers, and select the one that suits you best. With competitive rates and flexible terms, you’re just a step away from securing the ideal loan for your goals.

LOANS FOR INTERNATIONAL STUDENTS

Hit us up!

We’ll get back to you within 24 hours

By submitting this form, I confirm that I have read and understood Fly Finance Privacy Policy