CIBIL score for personal loans is one of the important factors that determine your loan approval. It lets the lender analyse the risk associated with lending you money because a personal loan is an unsecured loan. A good CIBIL score increases your chances of loan approval at lower interest rates. On the contrary, a bad score can hinder your financial prospects. To know more about why CIBIL score for personal loans is important, continue reading this blog.

Table of contents

What is CIBIL Score for Personal Loans?

The ideal CIBIL score for a personal loan is from 720-800. It also depends upon the bank and the lender what score they are considering in order to approve the loan. A high credit score, usually above 780-800 will get you a higher loan amount and you may also be able to negotiate the interest rates. On the other hand, if your credit score is below 750, the loan amount will be less.

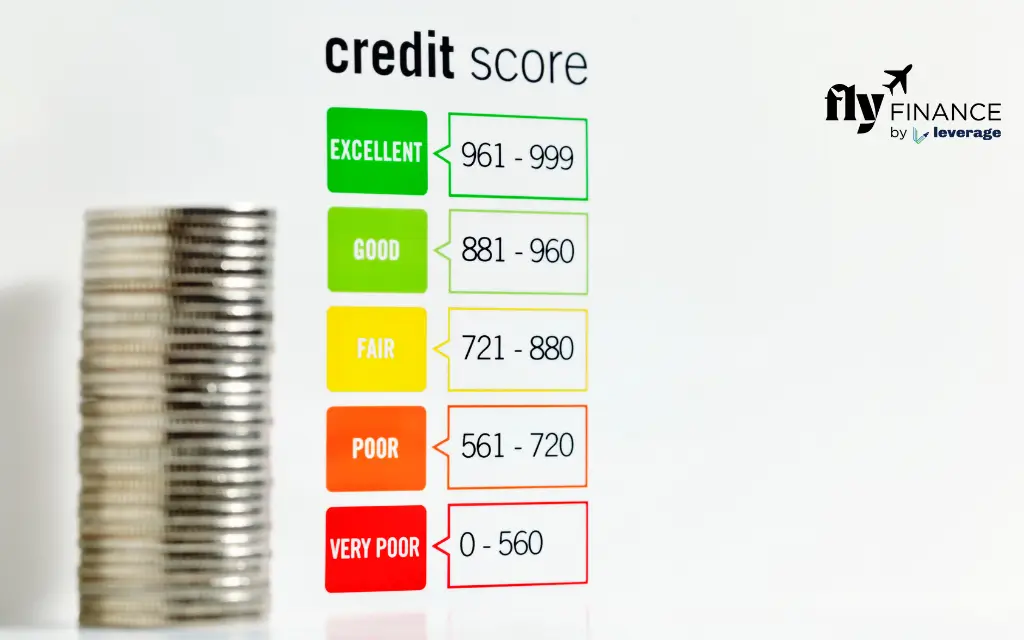

A CIBIL score between 750 and 900 is generally considered excellent for securing a personal loan on favourable terms. This range indicates a strong credit history and responsible financial behaviour. If you are still stuck- ‘Can I get a personal loan with a CIBIL score of 650 or 700’? here’s the answer. Well, you can qualify for it as a credit score between 650 to 700 is generally considered fair. However, lenders might offer less favourable terms and it could mean higher interest rates, lower loan amounts, or stricter eligibility criteria. Check the CIBIL score indicator below:

| Understanding CIBIL Score Ranges | |

| CIBIL Score | Meaning |

| 750 to 900 | Excellent creditworthiness, high chances of loan approval with competitive interest rates. |

| 650 to 750 | Good credit history, but lenders might analyse and assess your application more closely. |

| Below 650 | Considered a low credit score, making loan approval challenging and interest rates higher. |

Also Read: Check here and understand how to remove derogatory marks from credit reports.

Why CIBIL Score for Personal Loans is Important?

Since personal loans are unsecured loans, meaning you don’t have to pledge collateral/ security, the risk of losing money with the lender is high. So, the CIBIL score is an important indicator before you can avail of personal loans. Lenders rely heavily on credit scores and history to assess the risk and determine your eligibility for personal loans and the terms you’ll receive.

- A good credit score indicates a higher probability of repaying the loan on time. As a result, lenders may offer higher loan amounts and offer favourable terms and conditions, including lower interest rates on personal loans.

- A bad credit score indicates a higher risk of default payments on personal loans. Consequently, lenders are less likely to approve your loan application. However, if a personal loan with a low CIBIL score is approved, you’ll likely face higher loan interest rates.

What is a CIBIL Score?

A CIBIL score (or credit score) is a three-digit number representing your creditworthiness. It ranges from 300 to 900, with 900 being the highest. This score is calculated based on your credit history, including your repayment behaviour on loans, credit cards, and other credit facilities availed.

What is a Personal Loan?

A personal loan is a type of unsecured loan taken to meet financial obligations. It can be used for various purposes, including travel, marriage, home construction or renovation, education, paying medical expenses, etc. Personal loans up to INR 30 lakhs are easily available at interest rates of 10.50% p.a onwards for 12-60 months.

Also Read: Check out this blog to know all about personal loans and tax benefits, and learn how to claim for deductions.

Ways to Improve CIBIL Score for Personal Loans

So far, we have seen how important the CIBIL score is for the approval of personal loans. A bad score will limit the credit options and the choice of financial products. Thus, it’s crucial to maintain a good CIBIL score for personal loans.

Ensuring timely payments, settling outstanding debts, and reducing credit utilization are some of the common ways to improve your credit history. Boosting your CIBIL score for better loan prospects takes time and discipline. Follow these effective strategies to improve your credit score-

- Ensure timely payments of all credit card bills, loan EMIs, and utility bills.

- Maintain a low credit utilisation ratio, meaning the outstanding balance vs the credit limit should not be high.

- Avoid applying for multiple loans or credit cards within a short period.

- Prioritize clearing existing debts to improve your creditworthiness and CIBIL score for personal loans.

- Identify derogatory marks on credit reports by checking them regularly. Look for errors and dispute them if necessary by learning how to remove derogatory remarks from credit reports.

This was all about CIBIL score for personal loans. Always ensure to maintain a good credit history to increase your chances of securing loans with favourable terms.

To know more about education loans, the best bank accounts for students, forex and banking experience for global students or international money transfers, reach out to our experts at 1800572126 to help ease your study abroad experience.

FAQs

Most banks approve personal loans if you have a CIBIL score of 750 and above. A bad CIBIL score may lead to a lesser loan amount, a high interest rate or even the rejection of the loan.

A personal loan is a type of unsecured loan taken to meet financial obligations. It can be used for various purposes, including travel, marriage, home construction or renovation, education, paying medical expenses, etc.

CIBIL score for personal loans is important as it determines your eligibility and the terms you’ll receive. A good credit score can let you avail of higher loan amounts and offer favourable terms and conditions, including lower interest rates on personal loans.

Yes. A CIBIL score of 650 is considered a fair score that lets you avail a loan. However, lenders might offer less favourable terms and it could mean higher interest rates, lower loan amounts, or stricter eligibility criteria.

A CIBIL score between 750 and 900 is generally considered excellent for securing a personal loan on favourable terms. This range indicates a strong credit history and responsible financial behaviour.

Lenders are less likely to approve your loan application if your credit history is bad. However, if a personal loan with a low CIBIL score is approved, you’ll likely face higher loan interest rates and very low loan amounts based on your employment status and income ability.