Inflation is affecting Canada rigorously and as a consequence the cost of living is increasing in Canada in 2024. One needs to plan in advance regarding management of finances for the students who are going to or are already studying in Canada. It might appear as a burden but there are various solutions that can be looked into for this arising problem.

Also Read: How to manage finances as an international student

What is the current inflation rate?

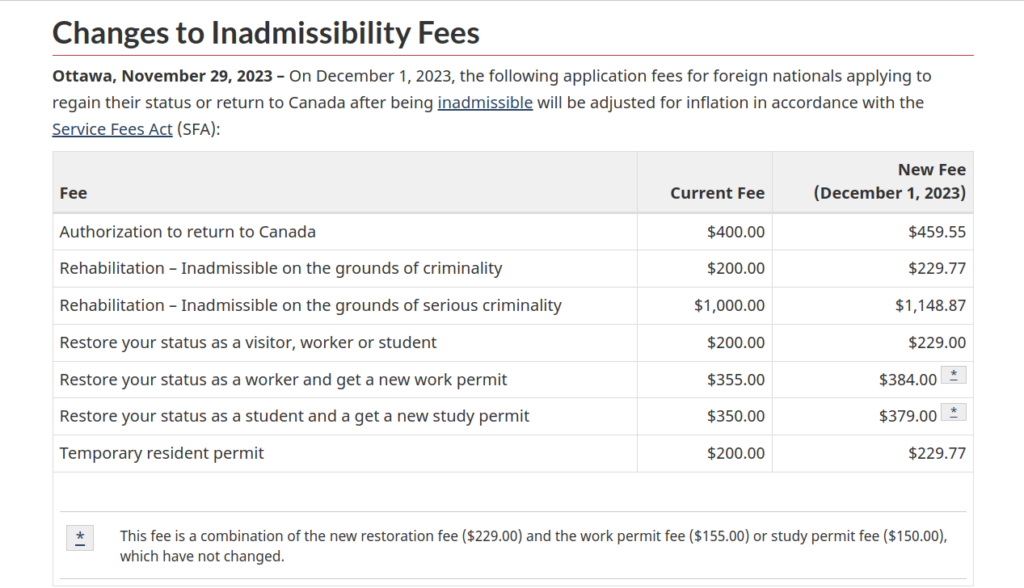

As per the reports of the Bank of Canada of July 2023, the annual inflation rate increased by 3.3%. The anticipated rate was 2% for 2024 but higher spending has kept the inflation high and as a result the inflation rate continues to be high. Therefore, the Bank of Canada has decided to keep the interest rates high in order to reduce consumption.

What can be done about it?

- As inflation is increasing, so is the cost of housing and living. Hence, it is becoming really expensive to pursue a degree in Canada. The best way to deal with this cost of living issue is to plan everything in advance.

- Experienced and reliable counselors can be contacted to provide resolutions for queries.

- It is advisable to book accommodation well in advance so that it could be booked at cheaper prices. For example – If you are in for September intake, try to book accommodation in May or June to avoid extra charges in the end.

- One can take the help of consultants to get a fair idea of the expenses and plan accordingly.

- One can research on finding cheapest currency exchange methods and can use forex cards for the same in order to avail various discounts.

How is it going to affect you as an International student?

As the cost of living is increasing significantly in recent years, it is definitely putting a lot of pressure on the pockets of people which in turn is affecting their financial management. The growing cost is not only affecting the everyday budgeting but is also affecting areas like healthcare, housing, schooling putting everyone including international students in a difficult situation.

The solution to this problem is to follow a student budget planner and manage your expenses. Also, planning, managing and executing the finances in advance definitely contribute to a smoother experience.

Also Read: Find all answers on Currency exchange rates for students

Follow the Fly Finance Newsdesk to get regular updates on study abroad loans, the latest guidelines, international money transfers etc.