Navigating international banking can feel overwhelming, especially when terms like IBAN and Swift code come up. These two codes play critical roles in ensuring smooth and secure cross-border transactions, yet they serve distinct purposes. Understanding the difference between IBAN and Swift code is essential for anyone dealing with global payments, whether for education, travel, or business.

This blog breaks down the difference between IBAN and Swift Code with their meanings, uses, and key differences to help you make sense of international banking. Let’s get started!

Table of contents

What is the Difference Between IBAN and Swift Code?

IBAN and SWIFT codes are two essential components used to identify bank accounts and facilitate international transactions. While both IBAN and Swift codes are critical for international banking, they serve different functions. Understanding the difference between IBAN and Swift code helps clarify their roles in facilitating seamless transactions.

Below is a detailed comparison of IBAN vs Swift Code to highlight their distinctions.

| Aspect | IBAN | Swift Code |

|---|---|---|

| Full Form | International Bank Account Number | Society for Worldwide Interbank Financial Telecommunication Code |

| Purpose | Identifies a specific bank account for international transactions | Identifies a bank or branch for routing transactions |

| Length | Up to 34 alphanumeric characters | 8 or 11 alphanumeric characters |

| Scope | Account-specific | Bank or branch-specific |

| Geographical Usage | Primarily Europe, Middle East, parts of Asia, Africa, and Caribbean | Global |

| Example | DE89 3704 0044 0532 0130 00 | BOFAUS3N104 |

| Charges | May include transfer fees, service charges, and currency conversion (typically 3–5%). | Includes fees for transfers, processing, and currency exchange (around 3–5%). |

| How to Obtain | Available on account statements, through the bank’s official website, or via online IBAN checkers. | Can be found on official bank documents, bank websites, or by using SWIFT lookup tools. |

The difference between IBAN and Swift code lies in their focus: IBAN pinpoints the recipient’s account, while the Swift code directs the payment to the correct bank or branch.

Also Read: Difference between SWIFT and SEPA: SWIFT vs SEPA

Now that you have an idea of IBAN and SWIFT codes, let’s understand them in detail one by one.

What is an IBAN?

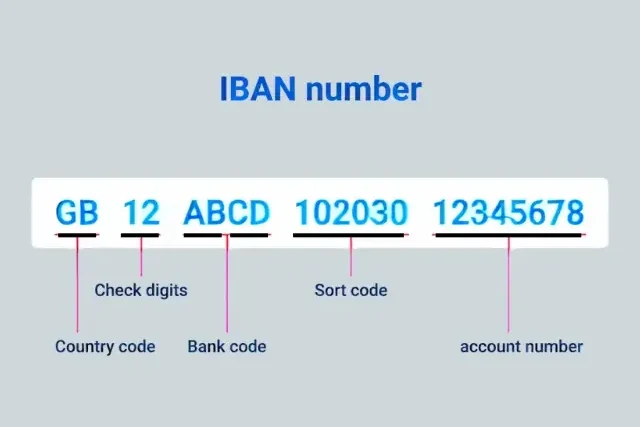

The International Bank Account Number (IBAN) is a standardized code used to identify bank accounts during international transactions. Developed by the International Organization for Standardization (ISO) and the European Committee for Banking Standards (ECBS), the IBAN ensures accuracy and efficiency in cross-border payments. Each IBAN is unique to a specific bank account, reducing errors in processing transactions.

- Structure: An IBAN consists of up to 34 alphanumeric characters, including a country code, check digits, and the bank account number.

- Example: For a bank account in Germany, an IBAN might look like DE89 3704 0044 0532 0130 00.

- Purpose: Validates account details and ensures funds reach the correct recipient.

- Usage: Commonly used in Europe, the Middle East, and parts of Africa, Asia, and the Caribbean.

The IBAN simplifies international payments by providing a uniform format, making it easier for banks to process transactions without manual intervention.

How to Transfer Money Using IBAN?

Now, How to Transfer money using IBAN? Transferring money using an IBAN is a straightforward process, especially for cross-border payments within IBAN-compliant countries. Lets understand the steps to transfer money using IBAN:

- Track the Transfer: Most banks provide a reference number or tracking option to monitor the status of the transfer.

- Obtain the Recipient’s IBAN: Request the correct IBAN from the beneficiary. Ensure there are no missing or incorrect characters.

- Log In to Your Bank Account: Access your online banking portal or visit your local bank branch.

- Choose the International Transfer Option: Select the option for international or SEPA (Single Euro Payments Area) transfers, if applicable.

- Enter the Required Details: Fill in the following:

- Recipient’s full name and address

- IBAN of the recipient

- Amount to be transferred

- Purpose of the transfer (if required by the bank)

- Add the SWIFT/BIC Code (if required): Some banks may require the SWIFT code of the recipient’s bank in addition to the IBAN.

- Review and Confirm: Double-check all details to avoid errors or delays. Confirm the transaction after verifying the information.

- Track the Transfer: Most banks provide a reference number or tracking option to monitor the status of the transfer.

What is a Swift Code?

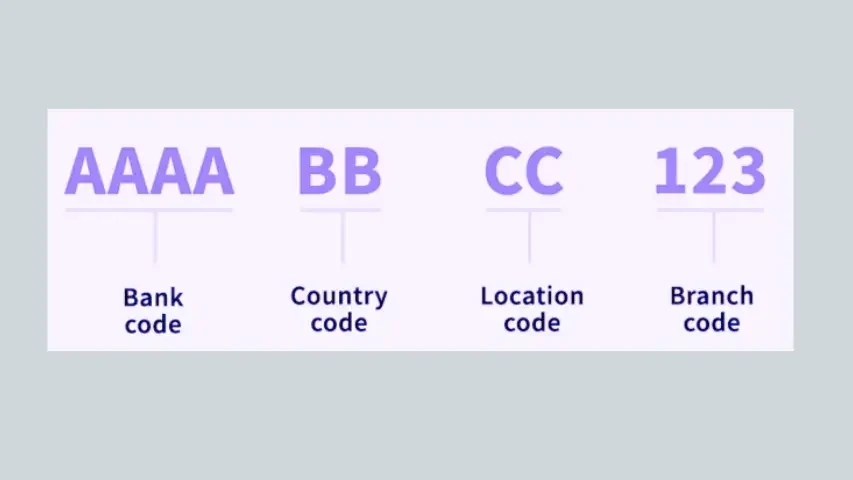

A Swift code, also known as a Bank Identifier Code (BIC), is a unique identifier for financial institutions involved in international transactions. Managed by the Society for Worldwide Interbank Financial Telecommunication (SWIFT), this code ensures that funds are directed to the correct bank, even across continents. Swift codes are essential for secure and efficient global banking.

- Structure: A Swift code is 8 or 11 characters long, comprising a bank code, country code, location code, and optional branch code.

- Example: A Swift code for any specific State Bank of India branch is like SBININBB104 (This is just an example, not a real code).

- Purpose: Identifies the bank and its branch during international wire transfers.

- Usage: Used globally by banks and financial institutions for cross-border payments and messaging.

Swift codes act like an address for a bank, ensuring that international transfers are routed accurately.

How to Transfer Money Using SWIFT Code?

Transferring money using SWIFT code is a straightforward process, especially especially when the recipient’s bank is located in a different country. Lets understand the steps to transfer money using SWIFT code:

- Collect the Recipient’s Banking Details

Obtain the following information from the beneficiary:- Full name and address

- Bank name and address

- Bank account number or IBAN (if applicable)

- SWIFT/BIC code of the recipient’s bank

- Log In to Your Online Banking Portal

Access your bank’s internet or mobile banking platform. You may also visit your local branch if you prefer in-person transactions. - Select International Transfer or Wire Transfer

Navigate to the option for making an international or wire transfer. - Enter the Required Information

Input the recipient’s banking details including:- SWIFT code

- Bank account number

- Recipient’s name and address

- Transfer amount and currency

- Purpose or reason for the transfer (if required)

- Review Fees and Exchange Rates

Check the applicable transaction fees, exchange rates, and estimated delivery time before confirming the payment. - Confirm and Submit the Transfer

Verify all the details carefully. Once confirmed, authorize the transaction using your bank’s security process. - Track the Payment

After submission, your bank may provide a transaction reference number or receipt, which you can use to track the transfer’s progress.

Also, Read: What Is a Same Currency International Transfer?

When to Use IBAN and Swift Code?

Knowing when to use an IBAN or Swift code is crucial for error-free international transactions. Each code applies in specific scenarios, depending on the nature of the payment and the countries involved. Here are the situations where IBAN and SWIFT codes are applicable.

- IBAN: Required for transactions within the Single Euro Payments Area (SEPA) and other regions where IBAN is standard. For example, sending money to a friend’s account in France requires their IBAN.

- Swift Code: Necessary for global wire transfers, especially when IBAN is not used. For instance, transferring funds to a bank in the United States typically requires the bank’s Swift code.

- Both: In many cases, such as payments to Europe from Asia, both IBAN and Swift code are needed to ensure the transaction reaches the correct account.

Always verify the required codes with the recipient’s bank to avoid delays or failed transactions.

Grasping the difference between IBAN and Swift code is more than just technical knowledge—it’s about ensuring your money reaches its destination safely and efficiently. Incorrect or missing codes can lead to delayed payments, additional fees, or even funds being sent to the wrong account. For instance, in 2023, the SWIFT network handled over 11.8 billion messages, underscoring the importance of accurate routing for global finance. By using the correct codes, you minimize risks and streamline international payments.

FAQs on IBAN vs SWIFT

The difference between IBAN and Swift code is that the IBAN identifies a specific bank account for international transactions, while the Swift code identifies the bank or its branch, ensuring accurate routing of funds.

You need an IBAN for transactions in regions like Europe, the Middle East, and parts of Asia, especially within the SEPA zone, to specify the recipient’s bank account.

The most widely used protocol for international transfers between members of the Eurozone and its neighbours, including Switzerland, Turkey, Israel, and the United Kingdom, is IBAN. Even though it is less widely utilised than the SWIFT system, IBAN is nevertheless used in other places.

A Swift code is required for most global wire transfers, particularly when the recipient’s bank is not in an IBAN-using region, like the United States.

In most cases, you need either or both codes for international payments. Missing codes may cause delays or failed transactions, so verify with the bank.

An IBAN can have up to 34 alphanumeric characters, while a Swift code is shorter, with 8 or 11 characters, depending on whether it includes a branch code.

Yes, for many international transfers, especially to Europe, both an IBAN and Swift code are required to ensure the payment reaches the correct account.

You can find your IBAN on bank statements or online banking portals. Swift codes are available from your bank’s website or by contacting customer service.

No, IBAN is primarily used in Europe, the Middle East, and parts of Africa, Asia, and the Caribbean. Countries like the US rely on Swift codes and other systems.

Incorrect or missing IBAN or Swift codes can lead to misrouted payments or rejections by banks, causing delays or additional fees.

Banks may charge fees for international transfers, but the IBAN and Swift codes themselves are free to obtain and use. Check with your bank for details.

No, an IBAN number is not the same as a Swift code. The IBAN (International Bank Account Number) identifies a specific bank account for international transactions, ensuring funds reach the correct recipient. In contrast, a Swift code (Bank Identifier Code) identifies the bank or its branch, guiding the payment to the right financial institution. Both serve distinct roles in global banking and are often used together for accurate cross-border transfers.

You cannot directly derive a Swift code from an IBAN, as they serve different purposes. However, an IBAN includes a bank code that can help identify the financial institution. To find the Swift code, contact the bank associated with the IBAN, check the bank’s website, or use online Swift code lookup tools by entering the bank’s name and branch location. Always verify with the recipient’s bank to ensure accuracy for international transactions.

This is all about the Difference Between IBAN and SWIFT code for more such informative blogs follow Leverage Edu